Life Insurance Sector and HDFC Life

What is Life insurance?

Life insurance is a contract between an insurer and a policy owner. A life insurance policy guarantees the insurer pays a sum of money to named beneficiaries when the insured dies in exchange for the premiums paid by the policyholders during their lifetime.

How does life insurance work?

Life insurance policies offer

a death benefit in exchange for paying premiums to the insurance provider

during the term of the policy. One popular type of life insurance—term life

insurance—only lasts for a set amount of time, such as 10 or 20 years during

which the policyholder needs to offset the financial impact of losing income.

Permanent life insurance also features a death benefit but lasts for the life

of the policyholder as long as premiums are maintained and can include cash

value that builds over time.

Term life is generally less expensive than permanent

life because it does not involve building a cash value. The cash value of permanent

life insurance serves two purposes - It is a savings account that the

policyholder can use during the life of the insured; the cash accumulates on a

tax-deferred basis.

Key Terms :

VNB- Value of new business is used to measure the profitability of

the new business written in a period. It is the present value of all future

profits to shareholders measured at the time of writing the new business

contract.

VNB Margin -VNB margin indicates the profit margin of Life

Insurance Company. VBN margin is calculated by dividing the Value of New

Business by Annualized Premium Equivalent. E.g. A VNB margin of 20% would mean

that if the insurer underwrote a new business premium for a particular mix of

products of Rs. 100 in a year, the expected profit over the lifetime of that

business is Rs.20.

Solvency Ratio - The solvency ratio defines how good or bad an

insurance company’s financial situation is on defined solvency norms. According

to Insurance Regulatory and Development Authority of India (IRDAI) guidelines,

all companies are required to maintain a solvency ratio of 150% to minimize

bankruptcy risk.

Embedded Value - Embedded Value is the measure of the value of the

Life insurance Company. This is an important metric, which reflects the

expected profitability from the current underwritten policies plus current net

worth.

EV is computed as the sum of the

adjusted net worth (ANW) and the discounted value of profits from in-force

policies (VIF).

Adjusted Net Worth consist of

Free surplus (FS): FS is the

Market value of any assets allocated to, but not required to support the in-force

covered business as at the valuation date. The FS has been determined as the adjusted

net worth of the Company (being the net shareholders’ funds adjusted to revalue

assets to Market value ), less the RC.

Required capital (RC): RC is

the amount of assets attributed to the covered business over and above that required

to back liabilities for the covered business . The distribution of this to shareholders

is restricted. RC is set equal to the internal target level of capital equal to

170% of the factor based regulatory solvency requirements, less the funds for future

appropriations (“FFA”) in the participating funds.

Present value of future profits

(PVFP):PVFP is the present value of projected distributable profits to shareholders

arising from the in-force covered business determined by projecting the shareholder

cash flows from the in-force covered business and the assets backing the associated

liabilities.

Time Value of Financial Options

and Guarantees (TVFOG) : TVFOG reflects the value of the additional cost to

shareholders that may arise from the embedded financial options and guarantees attaching

to the covered business in the event of future adverse market movements. Intrinsic

value of such options and guarantees is reflected in PVFP.

Frictional costs of required capital

(FC) : FC represents the investment management expenses and taxation costs

associated with holding the RC. VIF includes an allowance for FC of holding RC

for the covered business . VIF also includes an allowance for FC in respect of the

encumbered capital in the Company’s holdings in its subsidiaries.

Cost of residual non-hedgeable

risks (CRNHR) : CRNHR is an allowance for risks to shareholder value to the

extent that these are not already allowed for in the TVFOG or the PVFP . In particular

, the CRNHR makes allowance for:

–asymmetries in the impact of the

risks on shareholder value; and

–risks that are not allowed for

in the TVFOG or the PVFP.

CRNHR has been determined using a

cost of capital approach . CRNHR is the present value of the cost of capital charge

levied on the projected capital in respect of the material risks identified.

Persistency Ratio -Persistency ratio is the proportion of

policyholders who continue to pay their renewal premium. It is a barometer for

the quality of sale made by the insurer. It is measured at different stages in

the life of the policy. These stages are like first year (13th month), second

year (25th month), etc.

The 13th month persistency

measures the renewal premium paid by the policyholder at the commencement of

the second year. Similarly, the 37th-month persistency and 61st-month

persistency indicate the percentage of policyholders who choose to continue

their policies at the end of the third and fifth year.

HDFC life -13th month persistency

ratio - 87.5% in FY2022.

Gross Written Premium (GWP) — The total premium (direct and assumed) written by an insurer before deductions for reinsurance and ceding commissions. It includes additional and/or return premiums. Written does not imply collected, but the gross policy premium to be collected as of the issue date of the policy, regardless of the payment plan.

Underwriting Risks

Underwriting risk is the risk

that the premiums collected will not be sufficient to cover the cost of

coverage. Insurance prices are established based on estimates of expected claim

costs and the costs to issue and administer the policy. The estimates and

assumptions used to develop policy pricing may prove to ultimately be

inaccurate. This may be due to poor assumptions, changing legal environments,

increased longevity, higher than expected weather catastrophes, or research breakthroughs

as to the causes of diseases.

Mortality Risks

The term “mortality risk” is used

in the context of life insurance, because the expected cost to the insurer

increases with the insured’s risk of mortality. Yet the two terms relate to the

same source of risk – uncertainty regarding insureds’ life span.

Regulatory Risks

Insurers face several sources of

risk related to regulation, including rate intervention, participation in

involuntary markets, assessment risk, limits on underwriting, reinsurance requirements,

and restriction on dividends.

More on - Embedded Value

Life insurance companies,

primarily European ones, are increasingly valued based on Embedded value (EV)—a

metric voluntarily disclosed by large life insurers, which measures the consolidated

value of shareholders’ interests in the covered business. EV consists of the following

components:

Embedded value (EV) = Adjusted

Net Worth (ANW) + Value of in-force business (VIF)

Where ANW is calculated by

adjusting statutory capital and surplus to include some non admitted assets,

apply mark-to-market adjustments for some assets, and subtract surplus notes and debt (non-equity surplus). VIF is the

discounted value, as of the valuation date, of after-tax profits expected to be

generated by the business in force until the “material” portion of in-force business

has run off.

Embedded value differs from

intrinsic equity value for the following reasons. First, the cash flows

projections used in the VIF calculation involve significant discretion, which companies

may exploit to manipulate the EV estimate. In particular, the forecasting of

cash flows requires assumptions regarding margins, charges, retention rates,

mortality, claim rates, expenses, tax, capital requirements, investment

returns, inflation, and discount rates. Many of these assumptions are quite

subjective. Second, embedded value does not include the value of future new

business, that is, the discounted value of distributable earnings from new

business yet to be written. Third, the disclosed embedded value is measured as

of the balance sheet date, while embedded value at the time of valuation may be

significantly different.

Therefore, when estimating equity

value, analysts adjust the disclosed embedded value; they either multiply it by

a price-multiple that is based on the price-to-embedded value ratio of comparables,

or they explicitly address limitations and distortions. For example, they may attempt

to “undo” potential manipulation, incorporate the impact of changes in relevant

factors since the measurement date, or add an estimate of the value of future

business.

While free cash flow valuation is

the primary fundamental valuation approach used to value non-financial

companies, it is rarely used to value financial service companies. This is due to

the differences between financial and non-financial companies.

Instead, financial service

companies are typically valued by discounting expected cash flows or earnings

that flow to or accrue to equity-holders. Three types of models are used:

(a) discounted dividend per

share,

(b) discounted net equity flows,

and

(c) the residual income model.

Although these models are

analytically equivalent, in practice their implementation involves different

assumptions and hence results in different value estimates.

Par and non par policy

|

Participating policy |

Non-participating policy |

|

A participating policy enables you, as a policyholder, to share the

profits of the insurance company. These profits are shared in the form of

bonuses or dividends. It is also known as a with-profit policy. |

In non-participating policies, the profits are not shared and no

dividends are paid to the policyholders. This type of policy is also known as

a without-profit or non-par policy. |

|

The bonuses or dividends are usually paid out annually. |

There are no non guaranteed payments in non-participating policies

because the profits are not shared. |

|

The bonus that is paid out under this policy is not guaranteed. It is

based on the performance of the insurance company. |

In case of a non-participating policy, there is no bonus or dividend

paid to the policyholder. However, there are guaranteed benefits on death of

the life insured, his/her survival and/or policy maturity. |

Source – IRDAI Annual Report

Property/Causality Insurance

P/C business was the industry’s business model: P/C insurers

receive premiums upfront and pay claims later. In extreme cases, such as claims

arising from exposure to asbestos, or severe workplace accidents, payments can

stretch over many decades. This collect-now, pay-later model leaves P/C

companies holding large sums – money we call “float” – that will eventually go

to others. Meanwhile, insurers get to invest this float for their own benefit.

Though individual policies and claims come and go, the amount of float an

insurer holds usually remains fairly stable in relation to premium volume.

For the P/C industry as a whole, the financial value of float

is now far less than it was for many years. That’s because the standard

investment strategy for almost all P/C companies is heavily – and properly –

skewed toward high-grade bonds. Changes in interest rates therefore matter

enormously to these companies, and during the last decade the bond market has

offered pathetically low rates.

The wish of all insurers to achieve great result creates

intense competition, so vigorous indeed that it sometimes causes the P/C

industry as a whole to operate at a significant underwriting loss. This loss,

in effect, is what the industry pays to hold its float. Competitive dynamics

almost guarantee that the insurance industry, despite the float income all its

companies enjoy, will continue its dismal record of earning subnormal returns

on tangible net worth as compared to other businesses.

Management’s role – Underwriting is the major

role which the management has Disciplined risk evaluation should be the daily

focus of insurance managers, who know that the rewards of float can

be drowned by poor underwriting results. All insurers give that message lip

service but only a few could walk the talk.

P&C (Property and Causality) vs. L&H (Life and Health)

PC reserves involve greater uncertainty than LH liabilities, PC insurers hold larger equity cushions and generally invest in less risky assets compared to LH insurers. They also reinsure significant portions of their exposure, issue insurance-linked securities, and arrange contingent capital facilities. In addition, because the timing of PC claim payments is less predictable and generally nearer than that of LH benefit payments, PC insurers invest in more liquid and shorter maturity (and therefore less interest rate sensitive) assets, particularly securities. In contrast, LH insurers often invest significant amounts in long term mortgages and risky securities.

Change in interest rates – Remedy and Impact

It leads to direct and indirect

effect on the business as VNB will

increase for the new policies that will be written at a higher interest rate.

Companies hedge the book to offset this risk at the time of writing the

premiums. They are actually exposed to, when interest rates rise, is to the

extent of the shareholders assets where there is no corresponding liability and

also the excess assets on the non-par book as well. Those are the ones that are

sensitive to the interest rates going up, the shorter end of the curve where

these shareholder assets and excess assets are in the VIF.

For example, how HDFC Life

manages such risk – “The yields have gone up by 130 basis points during the

quarter. So that is why you see the 700 crores on the interest rate

sensitivity. On the new business, the new policies as and when we write it, we

will be able to write it at a higher interest rate and all things being equal

we will be able to get a higher margin as well.”

It clearly indicates that as the

interest rates increases, the premiums are adjusted accordingly, this price

hedge in turn makes the industry quite robust during such times.

About HDFC Life

HDFC Life Insurance Company is

engaged in carrying on the business of life insurance. The Company offers a

range of individual and group insurance solutions. The portfolio comprises of

various insurance and investment products such as Protection, Pension, Savings.

Insurance industry’s inherent

nature of long break-even period around 9 to 10 years, and need for

bancassurance partnership provides very high entry barriers.

India has a life insurance

penetration of less than 3%. There is a large opportunity to expand the life

insurance business given the favorable demographics, rising prosperity, growing

household income and the increasing awareness of the need for financial

protection

Margins

HDFC Life has the highest margins (26% new business margins i.e. the profit

margin on new policies issued during a period). A diversified product mix and

distribution mix also helps HDFC Life tackle the cyclicality of capital markets

and changes in the regulatory and macro environment.

How? - "You will find that unit

linked has come down marginally, par is at a similar level, term has gone down.

There are a fair number of compensating effects in terms of what is happening

in the product mix itself."

“There could be instances in a

period where the spreads may have gone up to some extent, on some of the

products like annuities and maybe non-par, but that again depends on what the

rate is at a particular point in time, how are we reacting to competition

within the quarter.”

Growth

HDFC Life’s growth was above the

industry growth rate, resulting in an increase in its market share, in terms of

Individual Weighted Received Premium (WRP) to 9.3% in FY2022 from 6.8% in

FY2017. Clocked a growth of 16% in individual WRP in FY22 with a market share

of 14.8% and 9.3% in the private and overall sector respectively.

Company’s focus has shifted to

protection and retiral products in the last few years from savings products.

The share of the protection segment increased to 13.6% in FY2022 from 11.3% in

FY2018 in terms of total annualized premium equivalent.

HDFC Life witnessed a CAGR of

18.5% and 20.2% in the EV and VNB, respectively, during FY2018-FY2022. Further,

the VNB margin (calculated as VNB divided by APE) has increased consistently in

the last five years to 27.4% in FY2022 from 23.2% in FY2018. This was primarily

driven by the healthy growth in the higher-margin protection and annuity

products.

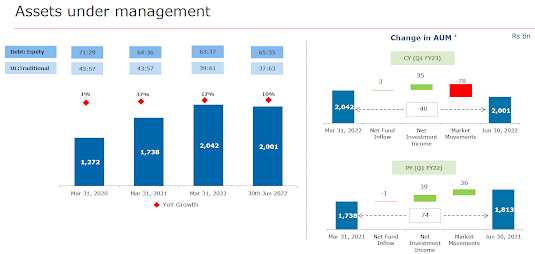

Subsidiary #1: HDFC Pension

crossed the 30000 Crores AUM mark and has almost doubled its AUM in just 15

months. As on June 30, 2022, HDFC Pension had a market share of 38% maintaining

its leadership position in the private pension fund manager space in terms of

NPS AUM.

Subsidiary #2: HDFC

International, the overseas subsidiary has received an in-principle approval

from International Financial Services Centres Authority - IFSCA to set up a

global in-house centre at GIFT city. This entity will pool and optimize all

processing activities of the international business.

Returns expected - Expected return

for the year is roughly around 8%.

Distribution network

It has tied up with 270 partners

(Micro finance Institutions, Small Finance banks, banks) for selling credit

protect policies (designed to pay off a borrower’s outstanding debts if the

borrower dies). The customer data from these partnerships is now being used to

cross sell other insurance products. Over 8% of total individual policies are

sold to existing credit protect customers.

The share of direct channels

(including online), on an individual APE basis, increased gradually to 19% in

FY2022 from 14% in FY2018 while the share of the bancassurance channel declined

to 60% in FY2022 from 71% in FY2018. Further, the company has been sourcing a

large part of its business in the individual category from the direct channel

(31-34%) in terms of new business premium in the last few years, which remains

high compared to peers.

Agency channel grew by 26%. The

channel added more than 40,000 agents in FY22, which is the second highest

amongst private players.

Product mix

Balanced and profitable product

mix, with non-par savings at 33%, participating products at 30%, ULIPs at 26%,

individual protection at 6% and annuity at 5%, based on individual APE. A large

part of that business is single premium so it is a 1:10, some of the business

is 5:10 (Premium paying term: Policy term).

New Products

HDFC Life recently launched a

protection plan - HDFC Life Click 2 Protect 3D Plus which refers to a feature

of the plan which it provides cover for 3Ds – Death, Disease, and Disability.

HDFC Life has an established

market position within life insurance industry. It has been among the top 3

players within the private sector space. HDFC Life's market share in terms of

new business premiums (both individual and group) stood at 21.5% during fiscal

2020. In terms of overall premiums (including renewal premium) market share

stood at around 5.8% as on March 31, 2020. Within private insurers, it

continued to maintain healthy market share of around 17.7% during fiscal 2020.

It also continues to benefit from its extensive industry expertise, as it has

been in operation for nearly two decades and has a presence across all the

states and union territories in India.

ROP (Return of Premium)

There are no accrued benefits in

the event of the maturity of the plan in case the policy holder survives the

policy term. However, there are insurance providers who provide the return of

premium option which entitles the policy holder to receive the premiums paid

during the policy term at the time of maturity of the plan. This can be seen as

additionally advantageous because together with the life coverage like a

traditional term insurance plan,

It is about a third of business

on the retail side. ROP is seen as a hybrid in terms of buying protection but

yes if nothing happens then money comes back.

Merger Impact

HDFC had a 47.81% stake in HDFC

Life followed by abrdn Limited (formerly Standard Life Limited) at 3.72% as on

March 31, 2022. In April 2022, HDFC had announced a scheme of amalgamation

whereby it would amalgamate with and into HDFC Bank Limited (HDFC Bank). As and

when HDFC Life becomes a subsidiary of HDFC Bank, there will be better opportunities for cross-selling and upselling.

HDFC’s majority stake, its representation on HDFC Life’s board of directors and

the presence of a shared brand name and HDFC will provide support to HDFC Life,

as and when required.

Idea is to create a one-stop shop for all financial services solutions, right

from perhaps opening up a small savings account when he or she just starts job,

to subsequently giving a mortgage when you get married or thereabouts in terms

of lifestyle, getting your first policy when you are having a kid, health

insurance, top-up mortgage and thereafter some fixed deposits, retirement

solutions, mutual funds in terms of your surplus that you want to re-invest,

all of that.

Covid Impact

Witnessed a decline in its net

profit in FY2022, resulting in a low return ratio mainly driven by one-time

Covid provisions. The higher claims were due to the increase in the scale of

business, the rise in the share of the protection business and high net Covid

death claims of ~Rs. 818 crore in FY2022 from Rs. 145 crore in FY2021.

Liquidity Position

HDFC Life reported liquid assets of Rs. 1,12,497 crore as of March 31,

2022. In FY2022, actual benefits/claims paid stood at Rs. 31,864 crore.

HDFC Life reported consolidated assets and a net worth of Rs. 2,30,734

crore and Rs. 15,613 crore, respectively, in FY2022 compared to Rs.

1,79,655 crore and Rs. 8,640 crore, respectively, in FY2021. It reported a

consolidated profit after tax of Rs. 1,327 crore in FY2022 compared to Rs.

1,361 crore in FY2021.

Risk Management

Managing risk is important for

all companies. The primary benefits of successful risk management relate to the

costs of financial distress and income taxes. For insurers, successful risk

management also reduces the likelihood and extent of costly regulatory

interventions and dividend restrictions.

The non-par is about 33% of total

new business. The risk management is reasonably straightforward as you could

expect, and from a hedging perspective also it works fairly well to hedge the

business that were written at the longer end as well. The capacity to write non

par is probably going to increase from here on given the way the business has

created diversified product mix and also the external support that is available

through hedging instruments. They launched some new products to cross hedge

internally.

“Our dependence on FRA is

probably a lot lower than maybe overall at an industry level, and we manage

dynamically in terms of which hedging instrument is going to be more effective

from multiple fronts at the backend at regular intervals.”

HDFC Life follows a fairly comprehensive approach to financial risk management, targeting duration matching on the Annuity business and cash flow matching on the non-par savings business. The company also follows a strategy of prudent pricing and dynamic repricing of new business. A judicious mix of multiple instruments is used to hedge interest rate and renewal premium reinvestment risk.

What is FRA?

Forward rate agreements (FRA)

are over-the-counter contracts between parties that determine the rate of

interest to be paid on an agreed-upon date in the future. In other words, an

FRA is an agreement to exchange an interest rate commitment on a notional

amount.

Number Crunching

Audit fees in connection with the

audit of the accounts of the Company for the FY 2021-22.

1.

M/s Price Waterhouse Chartered Accountants LLP - Rs. 57,00,000

2. M/s G.M. Kapadia & Co - Rs. 57,00,000

Working

One is that out of every 100

applications, company is converting about 61. Company has launched MediEasy.

What it does is that it walks with frontline salesperson step-by step because

what company finds is that the rules keep changing because of pandemic, because

of reinsurer, because of what they are looking at in terms of addressing new

and emerging risks and so on.

However, the guy on the field is

very confused, there is attrition, there is people movement, and then there is

a lot of back-and forth, and the customer gives up or the frontline salesperson

gives up on combination of these.

The first step is to say okay, we

need this document; if you do not have this document or rather the customer does

not have this document then they have a call center, which has an assisted call

center with chartered accounts to say okay, instead of this especially for the

non-salaried this is fine. Because the guy is sitting with the customer or

sitting virtually with the customer, and he is able to get, that rather than it

is coming back to central operation going back-and-forth and so on.

Similarly, looking at what other data

points were resulting in same 100 minus 61 why has there been a drop of and is

there some other ways of getting to the same answer. For example, today, they

do not have a deduping between the credit life database and the individual

database.

Now with the use of technology,

they can try and see personas of what is behind this person in terms of both

financial risk as well as medical risk that again could help address some of

that drop off. Similarly with reinsurer, they have been partnering with the

reinsurers and that has been well appreciated in fact reinsurers have come back

to say that there are errors and a little bit on the side of caution is

required.

If you also look at MediTech for

example, whole host of things shows how do they get a proxy for diabetes, how

do they get a proxy for any heart related illness without that individual going

in for a medical, which obviously given the pandemic, he or she is hesitant to

do that. They are able to triangulate that with age, with various other

datapoints, and his or her resistance to go in to get a medical being able to

use MediTech to be able to solve that.

Underwriting engine, which was launched

for savings, has an error rate of 0.001% now and it is ML so it is a machine

learning tool, which is getting even better day by day. They rolled it out

wherein human underwriters have been substituted so that the customer can be

given a straight through processing, can be given much better experience.

Now the next phase is to start taking

baby steps to look at term as well. What this will do is that, now again how to

reduce the drop off rate, and to increase the funnel also admittedly, but that

is one part of it. They are saying that people have come in out of the example

of 100, people have paid money, filled in the proposal, and they are not able

to issue them with the policy and return their money.

Company is doing cardiac risk

assessment which would help in better risk assessment.

“This is something we have been

solving for the past 24 months at least because getting people to go to a

hospital or a nursing home to do their stress test during COVID and so on was

just becoming a roadblock.” (Lower conversion rate -61/100)

Margin guidance – 30%

Solvency Ratio – 209%

EV = Rs. 300bn

RoEV – 17-18%

VNB = Rs. 26.8bn (FY22)

PAT = Rs 1210 Cr (FY22)

Growth of CAGR 24% seen in VNB from FY17-22

Anti Thesis

Short term impact on P&L due

to acquisition of Exide Life.

The company’s operating expense

ratio remains higher compared to listed peers primarily due to the absence of

exclusive tie-ups in the relatively lower-cost bancassurance channel.

Regulatory changes.

High valuations and financial

community’s bearish stance.

Thesis

India’s insurable population estimated to be 1bn by 2035. As

life insurance penetration - 3.2% and Life insurance Density – 59

Underpenetrated Pension market – 9.3% of GDP.

High persistency Ratio – repeated business.

Increasing Life expectancy and young population composition.

Strong promoters –HDFC group.

Private players gaining market share since FY16.

Return on EV -14-16% range (Industry leading)

Long term investment – more compounding tenure.

Quiet reasonable underwriting team.

Disclaimer - This is only for educational purpose. This is not an investment advice.